Already told you:

Read about Penguin/SS

Read about JetBlue/Spirit

Read about AA/JetBlue

Look at the examples you're giving. Everyone in this thread has been saying that the box office is dying, so clearly there isn't an anticompetitive motive in consolidation when it comes to the box office. Increasing prices won't help the box office survive. When it comes to streaming which is the bigger animal, there is plenty of competition and this wouldn't reduce competition at all since Sony does not have a streaming service of their own comparable to Paramount+. It also won't change the dynamic for cable carriers.

Gaming is nowhere near as concentrated as Hollywood.

The Judge for the MSFT case had a son working for MSFT.

Appeal courts have already heard the FTC appeal and we're waiting on a decision.

So a flimsy excuse. Got it.

Impossible? No.

Sports rights bidding are backed by ver ybig buyers, such as Apple or Amazon and soon to be Netflix.

Dominant? Yes.

Sound familiar?

Amazon and Apple aren't going to be able to outbid Disney/WB/Fox... A sports channel with the combination of the rights they already have access to, means that every sport HAS to be on it. If that's where people can get their sports, that's where they would have to go. The only way to break that would be collusion. Amazon, Apple, and Netflix would have to offer far more than they worth, and they're not going to do that either, and that will eventually drive the price of the sports leagues down too, because now the Sports cartel will have leverage. It's textbook antitrust, that you can't see that but someone complaining about Sony/Paramount is laughable.

Nonsense. Just complete nonsense

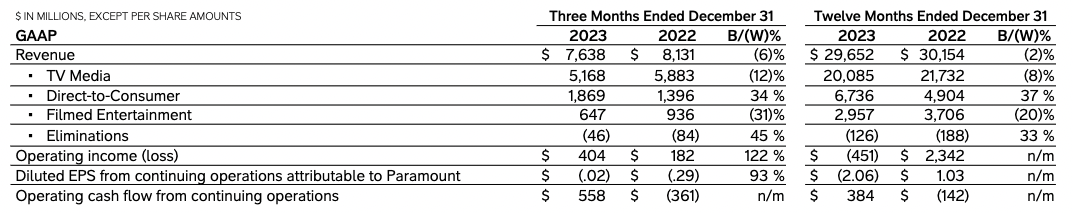

1 Universal 42 $1,826,823,077 169,464,100 20.42% 2 Walt Disney 12 $1,446,951,947 134,225,597 16.17% 3 Warner Bros. 31 $1,412,786,409 131,056,253 15.79% 4 Sony Pictures 27 $982,565,789 91,147,108 10.98% 5 Paramount Pictures 10 $844,379,150 78,328,306 9.44%

5 companies control 70%+ of the market.

Do you see who the both 4 and 5 are? Together they barely add up to either 2 or 3 and that is with 37 movies and this is just box office...for one year.

4-5 companies controlling this much box office isn't a monopoly nor does it pose a antitrust problem.

Current FTC/DOJ would block any merger between major phone companies lol.

T-mobile/Spirit happened under Trump admin, Trumps DOJ and FCC approved both deals lol

You're just further proving my point.

Stop projecting Donald Trump's admin onto the current FTC/DOJ.

lol... they JUST let Warner and Discovery merge... which you're conveniently ignoring.