This is actually a REALLY valid point. I was about to reply to

@thicc_girls_are_teh_best and accept that we were wrong until I read your comment.

This is an accounting practice that can (legally) "fudge" these numbers. The $116 ARPU seems way too much. That implies that almost nobody is using the $1 upgrade path, which we know isn't true.

But if they count a GP sub as, say, $120 then that figure becomes a part of the overall revenue. All the "discounts" are then deducted as discount expenses while calculating operating income, for which MS didn't share the figure. If Hezekiah is right, then that ARPU will come crashing down at that point.

IIRC, MS does follow this accounting practice. Someone like

@Bryank75 or

@Darth Vader will have better information on this I think.

I'm just reading the ResetERA thread and they changed the title to "Microsoft subscription services" instead of just GamePass, implying the $2.9 billion also includes XBL Gold. Which would probably make more sense.

Because again, if GamePass were generating so much ARPU, why do the free sub giveaways with Verizon? Why offer the $1 conversions (tho since you need like 2-3 years XBL Gold to "convert" I guess those count as full GP subs, tho you can get XBL Gold for cheaper than $60/year)? Why have extended free trails? Why not reveal the revenue yourself and to your shareholders, instead of letting it spill out from a court document filed with Brazilian judiciaries?

If my for-the-future game subscription service were generating almost $3 billion a year off the subs alone I'd definitely boast about it to shareholders and use it as a point to prove to rivals and doubters that the model works. So something about that $2.9 billion being tied "just" to GamePass always felt off to me, though I was willing to accept it as well.

You and I might've been wrong about our own GamePass revenue figures speculation, but that's just the thing: might. And if so, maybe not by that much. $750 million/year or so might be on the low side in terms of revenue, but anything between that and $1.25 billion/year or $1.3 billion/year might be realistic. I'm thinking the number of XBL Gold subs is still somewhat higher than for GamePass because why would MS have tried doubling XBL Gold pricing last year to make GamePass more appealing to them?

Also the discounts you can get on XBL Gold annual subs are nowhere near what you can get on an annual GamePass or GamePass Ultimate sub, and more people are cool with spending $60/year on a service (or close to it) than $120/year or $180/year. It's the same reason why when Sony reveals updated PS+ figures, you're going to see way more on regular PS+ than PS+ Extra, and more on Extra than Deluxe/Premium. That's just basic economics.

I'm sorry but I'm not aware of Microsoft's accounting practices, however what you described is done aplenty in the business world. Say you're in the business of hardware and software sales. You report on your hardware and software sales at full price to boost your revenue, then include the discounted amount as a business expenses, a lot of times under "other expenses" so as not to clearly report on it. They may also include those "other expenses" on "server" or "manufacturing" costs, for example.

From an accounting standpoint the operating income should be the same, so you're not "fudging" numbers, but it helps to sell a narrative to your investors.

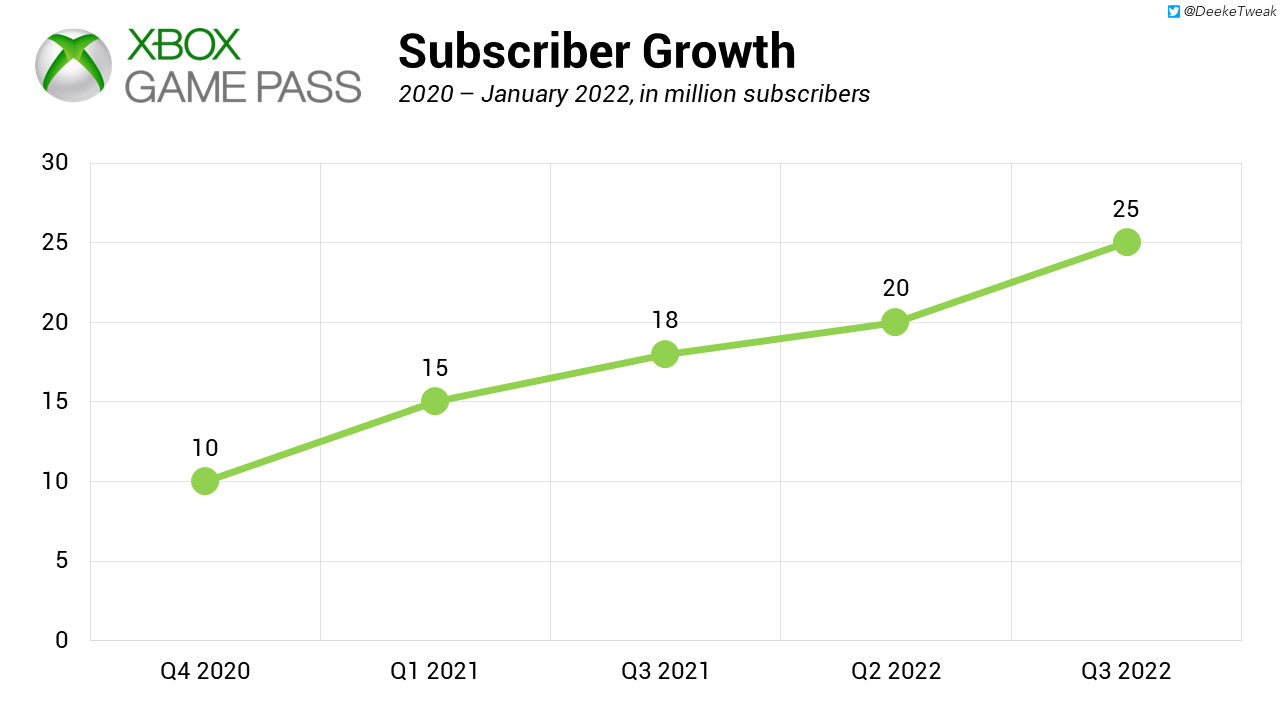

Assuming the numbers they provided are reported with the methods above, they would have to have averaged 24M gamepass subscriptions at $120 per subscription during 2021, which goes against the number reported here.

I think

@thicc_girls_are_teh_best hit the nail in the head when they said the gamepass revenue part could includes DLC and MTX revenue as well.

As for the hardware side of things, I'd love to see a breakdown of consoles vs hardware and peripherals. If we assume an average of $350 per console sold and for that revenue to be console exclusive, they'd have sold 10.5M consoles in 2021. My guesstimate would be at least $500M for revenue related to peripherals, which would put console sales at a maximum of 9M at the same average.

Sony reported on FY22 around $1.3B in "others" for their Playstation sales, which report on peripherals, PS VR and software on other platforms (PC), for example.

Yeah, it's either:

A

The figure pertains to multiple Xbox gaming services and not just GamePass (I'm only going by the thread title update on ResetERA so that may not be the best of sources), or

B

The figure

is specifically in reference to GamePass, but accounts for MTX/DLC purchases through the service. The ARPU is too high otherwise to line up with the strategies MS have taken to market and discount GamePass for virtually anyone who wants it cheap enough (MS Reward points, $1 conversions (though I think these would just be siphoning the equivalent XBL Gold ARPU of the person towards GamePass instead so not sure it counts as a "cheap" method for getting GP), free trails (apparently the same person can do multiple free trails as long as they use different email addresses and I'm presuming credit or debit cards, and some banks let you create a ton of virtual cards for online transactions).

And a breakdown on consoles vs peripherals would be neat, I'm sure at least some investors would like that, too. Because again, MS just report that lump sum of division revenue with no breakdowns. I just think it's a bit funny how they have the optics of transparency on the consumer-facing side (except if something's gone off-rails), but those same optics simply

don't exist and that transparency

completely gone for shareholders & investors, at least when it comes to the Xbox division's revenue splits (let alone profit).

No need to be a pro, you only need to read the image from CADE to see they are talking about the game subs revenue made by MS (which also includes non-GP Gold subs) and not only about GP. Same goes with Sony, it's clear that they are counting there both PS Now and PS+.

Which means your OP and the linked article are wrong.

Yep looks like you were right; they updated the title on the ERA thread too. Had a feeling something was off with the reporting and this helps calibrate things into better perspective.

So we still don't know what GamePass's annual revenue looks like but it's easier to speculate. Assuming XBL Gold ARPU is the same as with PS+, but having maybe half the number of subs, gives anywhere between $1.2499 billion - $1.51 billion in XBL Gold annual revenue. So at most, GamePass would be generating $1.65 billion/year which...well that's a lot more than I would've thought on the low end, but it's still an ARPU of $66/year per subscriber (@ 25 million subs), much lower ARPU than either XBL Gold, PS+, or NSO.

So an

extreme worst-case, GamePass only generates $750 million/year (

@Heisenberg007 we might gotta bite the bullet on that earlier figure from months back

), but I'm kinda gonna disregard this now given the new numbers & info, it's too improbable.

Realistic low-end is probably ~ $1.25 billion/year, realistic high-end ~ $1.5 billion/year. Which isn't too bad, though it's not great either considering the ARPU.

But again, that's just revenue, and that's before factoring in the costs for having all the 3P legacy games there (those costs might be contract-based set at an earlier date however), the costs for new 3P indie and AA releases Day 1 into the service, the costs for getting semi-new 3P AAA games in there like six months later, etc. Sony has to factor in these costs too when it comes to PS+, but they are likely paying notably lower amounts for all of those things considering their market position and how they can leverage that, their brand, etc. Also they don't do anywhere near the amount of Day 1 3P games for PS+ that MS does for GP.

:max_bytes(150000):strip_icc()/monopolistic-market-4192732-2-1a0a84322d2041c4b72d5ea41b836147.jpg)

:max_bytes(150000):strip_icc()/oligopoly-10a52aa9a9de45988ca1ac1e90d81ff1.jpg)

:max_bytes(150000):strip_icc()/low-angle-view-of-modern-office-buildings-skyscrapers-in-manhattan-midtown--new-york-1066278582-2b99c4f3f20641fb9bb8fb32a74e4d72.jpg)